how to avoid capital gains tax florida

Utilize O-Zones to Avoid Capital Gains Tax. That means that even if you have capital gains in a.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

If you have funds in an old 401 k or IRA you can roll them over to a self-directed IRA custodian.

. Your primary residence can help you to reduce the capital gains tax that you will be. Filing and paying Florida capital gains tax isnt necessary since Florida doesnt have state-specific rules. You sell it today for 450000.

You would owe capital gains taxes on 190000 the difference between your purchase price and your sale price. However in the most basic sense capital gains tax is money owed to the. The states are Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington and Wyoming.

By Florida Independent April 8 2019 5 minute read 0 Table of Contents 1. It lets you exclude capital gains up to 250000 up to 500000 if. What is the capital gain tax for 2020.

Nine states do not charge capital gains taxes. How to avoid capital gains tax on a home sale Live in the house for at least two years. However you must send federal capital gains tax payments to the IRS.

If you make under a certain amount per year you may qualify for a 0 capital gains tax rate. Long-term capital gains that is. So if you bought a stock for 1000 and sold it for 2000 you would realize a.

An accountant is your best bet when it comes to explaining capital gains tax. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. Long-term capital gains taxes on the other hand apply to capital gains made from investments held for at least a year.

Live on the Property and Sell Often 3. At the federal level and in some states these are taxed at. If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180.

The section 121 exclusion allows the following amounts to be excluded depending on your tax filing status. The two years dont need to be consecutive but house-flippers should beware. Long-term capital gains tax is a tax applied to assets held for more than a year.

Check for Exemptions 2. If you sell a house. How to Avoid Florida.

What is Capital Gains Tax. You have lived in the home as your. This allows you to sell the.

After all its awfully hard to reach financial freedom at a young age if you lose 30 to 50 percent of. 10 Ways to Reduce or Avoid Capital Gains Taxes. A capital gain is computed by subtracting the purchase price of an asset from the selling price.

Manage Your Tax Bracket. Key ways to avoid capital gains tax in Florida Take advantage of primary residence exclusion. According to the IRS you can avoid capital gains tax in Florida under specific conditions.

It depends on the property type and your tax filing status. A final way to avoid capital gains tax is to hold real estate within a self-directed IRA. Single 250000 Married 500000 The condition is that you must have lived.

Secondly if you are selling a rental property or an investment property you may be able to avoid capital gains tax altogether by doing a 1031 exchange. The long-term capital gains tax rates are 0 percent 15.

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Solved Can You Avoid Capital Gains Taxes On A Second Home

A Guide To Capital Gains Tax On Real Estate Sales The Ascent By Motley Fool

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

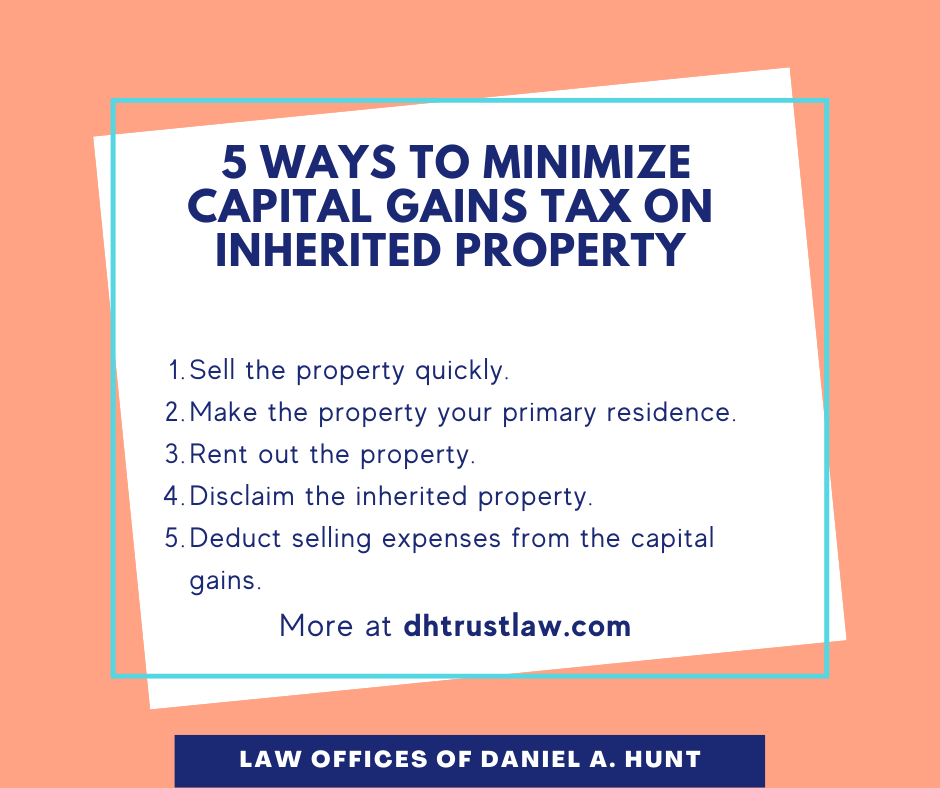

Do You Pay Capital Gains Taxes On Property You Inherit

Florida Real Estate Taxes And Their Implications

How To Avoid Capital Gains Tax On Stocks Smartasset

Capital Gains Tax In Kentucky What You Need To Know

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

3 Strategies On How To Avoid Capital Gains Tax When Selling Your Investment Property Duo Tax Quantity Surveyors

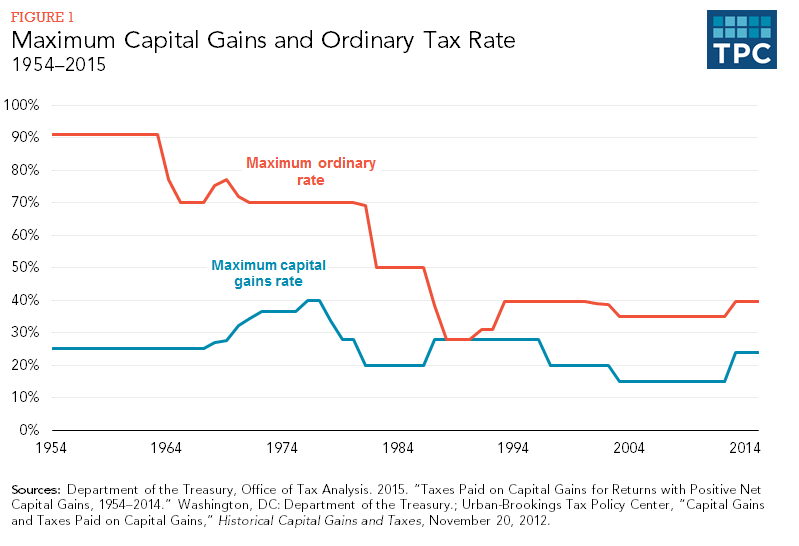

Capital Gains Full Report Tax Policy Center

Capital Gains Tax Ma Can You Avoid It Selling A Home

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

How To Avoid Capital Gains Tax When You Sell A Rental Property

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Avoiding Capital Gains Tax Strategies To Save You Thousands Live Q A Mark J Kohler Youtube

The States With The Highest Capital Gains Tax Rates The Motley Fool